The creation of Bitcoin, along with the Blockchain technology that enabled the digital currency, was a revolutionary act that has changed the world of finance forever. Originally envisioned as a transactional digital currency, Bitcoin has evolved more into an investment, or vehicle to speculate, due to the dramatic volatility in price changes. Traders love volatility – if they get it right.

But Bitcoin’s volatility is not the only hurdle the cryptocurrency has to endure. Bitcoin has some other shortcomings too. These character flaws have caused some industry participants to question Bitcoin’s long term viability. Earlier this month, Jason Calacanis said Bitcoin had a good chance of going to zero – a harsh prediction. Calacanis is a cryptocurrency believer – he just thinks other more viable digital currency options may usurp Bitcoin’s crown.

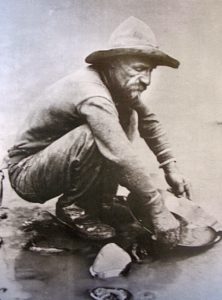

Many, perhaps most, cryptocurrency followers view Bitcoin more like a digital commodity – kind of like trading in gold – and there is nothing wrong with that. And if you think about it, that’s not a bad analogy and there is a good argument that Bitcoin has far more tangible value than a shiny metal found underground.

Many, perhaps most, cryptocurrency followers view Bitcoin more like a digital commodity – kind of like trading in gold – and there is nothing wrong with that. And if you think about it, that’s not a bad analogy and there is a good argument that Bitcoin has far more tangible value than a shiny metal found underground.

Crowdfund Insider recently reached out to Daniel Rice, the Chief Technology Officer of Sagewise and founder of the Bitcoin Developers Los Angeles & Orange County CTO Forum. Sagewise is moving into an interesting space as it is launching a dispute resolution platform and borderless, digital jurisdiction for smart contracts. Yes, cryptocurrency transactions may be “trust-less” but agreements are not always perfect. Rice is knee deep in the crypto space and is not lacking for opinion on what is working and what is not. He was happy to share his perspective and our discussion is below.

Bitcoin may be the most popular cryptocurrency but it has challenges beyond its popularity. There has been a lot of commentary on the slowness of the BTC Blockchain. Is this a nail in the Bitcoin coffin?

Daniel Rice: Part of what makes Bitcoin different than something like Paypal is that it attempts to be decentralized. That architecture goal creates certain tradeoffs, and transaction confirmation time is one of them. Other cryptocurrencies architect around different decentralization goals and may have faster or slower transaction speed and confirmation. Whether or not Bitcoin strikes the right balance from a user perspective is yet to be seen. Slow transactions may be a nail in the coffin for certain consumer uses, but not for other things like large transaction settlement. That said, there are tier two concepts currently being added to Bitcoin that could change the usability: Sidechains and payment channel technology like the Lightning Network to name two addons.

What about fees? Bitcoin was envisioned as transactional currency. Associated fees, and its overall valuation – do not really make that practical – yes?

What about fees? Bitcoin was envisioned as transactional currency. Associated fees, and its overall valuation – do not really make that practical – yes?

Daniel Rice: In its current form, Bitcoin transactions can cost an upwards of $30 USD, so it’s definitely impractical for daily usage. The valuation is not really a transactional issue since you can transact in small fractions of Bitcoins, but there may be a usability issue there that has not been addressed well.

In fiat currencies we tend to move the decimal point when the numbers get hard to manage. Sending .000065 bitcoins is pretty alien to the average person, so it is definitely a real issue that the Bitcoin community is thinking about and there have been several pushes to move the decimal point to a place that makes the currency more user friendly.

And what about all the energy Bitcoin mining needs? This cost is real, isn’t it?

Daniel Rice: Going back to decentralization, Bitcoin uses something called “proof-of-work” to protect the network. Bitcoin’s creator wrote in the original white paper “one-CPU-one-vote” meaning that anyone could participate in the network if they had a computer and mine for coins.

Today your computer cannot participate fully in the network because custom hardware has been created that can do “work” on the network much more efficiently. This special hardware can mine much faster rendering your computer useless for mining. Furthermore, most of the mining takes place in China. The cost is real and there’s starting to be a focus on the environmental impact of Bitcoin mining.

There are fundamental questions to be asked about whether or not proof-of-work has failed and should be re-evaluated for these reasons. Even without mining centralization in China, we have seen with other cryptocurrencies that botnets are being utilized to mine coins, and that leads to another negative outcome: Nobody wants the type of people who run botnets controlling the majority of the currency.

In your opinion, what is the solution? Is it IOTA (or something else)?

Daniel Rice: Ethereum (the second largest cryptocurrency by market cap today) is moving off of proof-of-work in favor of a lower cost alternative called proof-of-stake. The idea there is that your control of the network is based on your percent ownership of the coins instead of based on making your computer run computations. It has its own set of challenges, questions, and problems, but it does use less energy. There are federated approaches as well. For example, Stellar uses an approach where there is a starting list of nodes that are known and trusted automatically and no mining is required. This allows for lower network energy usage, faster transaction confirmation, and a higher volume of transactions. Again, the comparative costs relate to the differences in the architecture and the winner will strike the right balance.

To comment on IOTA directly, I recently published an article detailing my concerns around the platform and I’ve received a fair amount of coverage since IOTA is very popular. Something I didn’t cover in my article is that IOTA is currently using something called a “coordinator” which really just means that a centralized node controls the network. This means IOTA functions very similarly to Paypal in regards to centralization. Their whitepaper outlines a path to removing the coordinator eventually, but it’s hard to assess whether or not that future change will be successful. I don’t think it will be the winning solution.

What are other emerging crypto options you believe have a shot at becoming more relevant than Bitcoin?

Daniel Rice: Anyone can copy the Bitcoin source code and create their own cryptocurrency. Litecoin was created by copying the Bitcoin source and changing just a very small amount of code at first. Bitcoin can take good ideas from other cryptocurrencies as well. What this means is that in the long run the technology around cryptocurrency will be commoditized — if one has a technological lead, every other coin can copy  that code and match it. This is why technology will not be the driving factor towards the relevance of a cryptocurrency.

that code and match it. This is why technology will not be the driving factor towards the relevance of a cryptocurrency.

Assuming all technology can be matched and copied, we are left with a few concepts that we hear a lot from the general business world: First mover advantage, general project philosophy, traction, etc.

Some cryptocurrencies are different than Bitcoin because they focus on a different philosophy. Monero takes the approach of focusing on fungibility and the philosophy is that making transactions private by default creates better fungibility. Bitcoin transactions are public, so Monero and Bitcoin will most likely continue to be different for philosophical reasons. Monero privacy technology is not perfect, so I believe in the project based on their long term goals and philosophy, not just what they have built today. The technology behind it will need to improve and evolve.

Outside of that, I believe Ethereum has massive scaling issues ahead that will take time to solve, but the ecosystem they have developed around hosting ICOs on their platform gives them an advantage over other cryptocurrencies. They have a stronger ecosystem than Bitcoin in some ways and I think that could lead to Ethereum overtaking Bitcoin in market cap even in the next few months.

Lastly, smart contract platforms that strike a different decentralization balance than Ethereum could grow rapidly. I’m closely following the EOS platform which has not yet launched because it will theoretically be able to handle a much larger volume of smart contract transactions than Ethereum. It accomplishes this by being more processing-centralized, but that may still be worthwhile.

Any security concerns?

Daniel Rice: There are security concerns of all kinds: Bugs could exist in your wallet software, or in the exchange you use to buy. My suggestion is no matter how secure you think your setup is, don’t put all your eggs in one basket. Don’t store all your coins in one place. Don’t use one single wallet. Don’t put all your coins on one exchange. Don’t buy all of one cryptocurrency. Don’t access all of your coins using the same device. If you have a lot to lose, use multiple hardware wallets, use paper wallets. Diversification at every level is a good way to decrease your risk.